michigan gas tax revenue

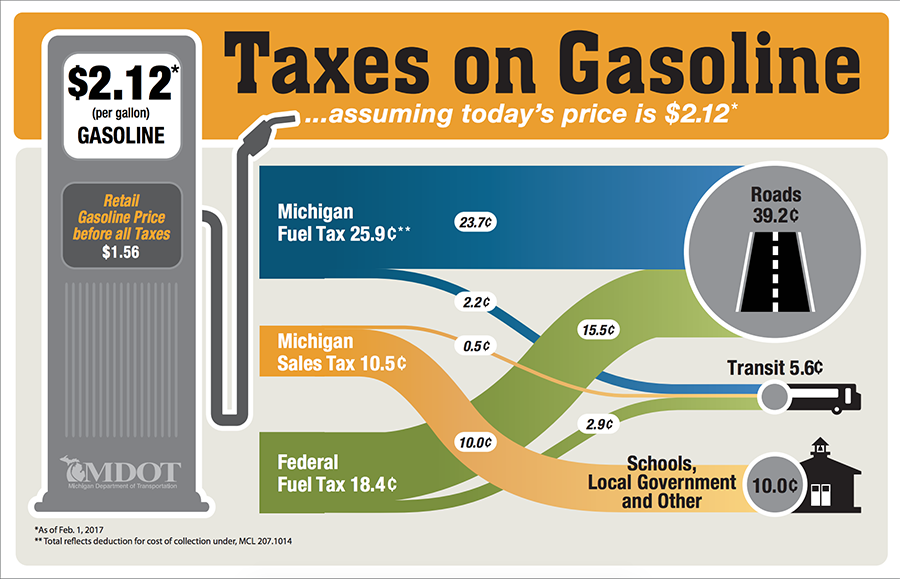

168 cents per gallon. The current federal motor fuel tax rates are.

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

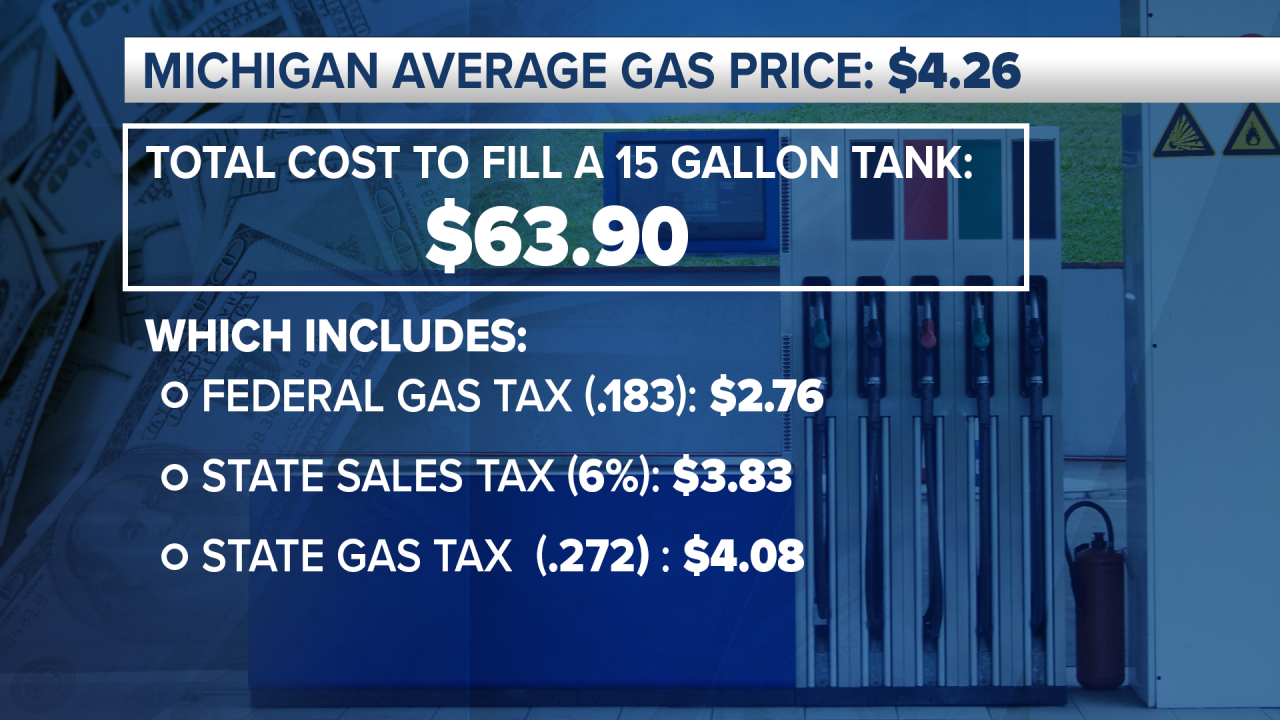

That household now pays about 1840 a month in Michigan gas taxes not including the sales tax.

. Prepaid Gasoline Sales Tax Rate. REVENUE SOURCE AND DISTRIBUTION. Michigans excise tax on gasoline is ranked 17 out of the 50 states.

This rate will remain in effect through April 30 2022. The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. SCHOOL AID FUNDReceives approximately 238 of gross collections per 2020 PA 75.

At this level of consumption and an average pump price of 350 per gallon the sales tax on gasoline sales would have generated approximately 8183 million in. But she opposes changes to Michigans gas tax. Producers or purchasers are required to report the oil and gas production and the value in a monthly return.

But that was based on. The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon. Michigan Gas Tax 17th highest gas tax.

Effective April 1 2022 the new prepaid gasoline sales tax rate is 176 cents per gallon. Combined business tax collections from the Single Business Tax. Effective April 1 2022 the new prepaid gasoline sales tax rate is 202 cents per gallon.

2015 PA 179 earmarked 1500 million of GFGP income tax revenue to the Michigan Transportation Fund in FY 2018-19 3250 million in FY 2019-20 and 600 million in FY 2020-21 and each year thereafter. In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year. Michigan Fuel Tax Reports.

171 cents per gallon. Call center services are available from 800am to 445PM Monday Friday. State Senate Democrats.

On top of other costs Michigan currently imposes a 19-cent per gallon excise tax on gasoline last updated in 1997. The same three taxes are included in the retail price on. LPG tax is due on the 20th of April July October and January Quarterly tax except for motor fuel suppliers 20th of each month.

Michigan severance tax returns must be filed monthly by the 25th of the month following the production. COVID-19 Updates for Michigan Motor Fuel Tax Motor Fuel Tax Return filing deadlines have not changed. Michigan Taxes tax income tax business tax sales tax tax form 1040 w9 treasury withholding.

0219 gallon Most jet fuel that is used in commercial transportation is 044gallon. Gretchen Whitmer a Democrat seeking reelection said the 25 billion package of tax cuts is. During the first nine months of FY 2007-08 sales tax collections from gasoline sales are running ahead of the FY 2006-07 level by 249.

Fuel producers and vendors in Michigan have to pay fuel excise taxes and are responsible for filing various fuel tax reports to the Michigan government. Alternative fuels such as compressed natural gas liquefied natural gas hydrogen and hydrogen compressed natural gas are taxed at 0263 per gallon equivalent. The Michigan gas tax is included in the pump price at all gas stations in Michigan.

Under the Senate plan itd pay about 4220 per month in 2018 if prices stay flat roughly 24. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan.

AP The Republican-led Legislature on Thursday gave final approval to a veto-destined bill that would cut Michigans income tax expand tax exemptions for older people and largely restore a per-child tax credit that was eliminated a decade ago. The Michigan Senate this week gave final approval to a bill that would suspend the states 272-cents-per-gallon gas tax for six months but the Republican majority did not have enough votes to give the bill immediate effect meaning it would not cut prices until 2023. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the.

Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they wrote. Approximately 44 billion taxable gallons of gasoline were consumed in Michigan in 2011. Motor Fuel Taxes In Michigan three taxes are included in the retail price of gasoline.

Effective for the period October 1 2021 through October 31 2021 the prepaid sales tax rates for the purchase or receipt of gasoline and diesel fuel are. Gas purchases generated an estimated 6532 million in sales tax revenue. Prepaid Diesel Sales Tax Rate.

Date sales tax revenue was up 181 from last year and 1222 million above the predicted level while use tax revenue was down 52 from last year but 318 million above the predicted level. Liquefied petroleum is taxed at 0263 per gallon. MTF Reports Act 51 Allocations Michigan Transportation Fund MTF payment breakdown information related to individual monthly payments to incorporated cities villages and county road commissions pursuant to Act 51 new revenue package estimated revenues and monthly and annual reports.

Gretchen Whitmer wants Congress to slash the federal gas tax and supports rolling back the states 6 sales tax on gas. At this pace sales tax collections from gasoline sales will top 8000.

Senate Oks 6 Month Suspension Of State Gas Tax But A Veto Is Likely

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

State Corporate Income Tax Rates And Brackets Tax Foundation

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

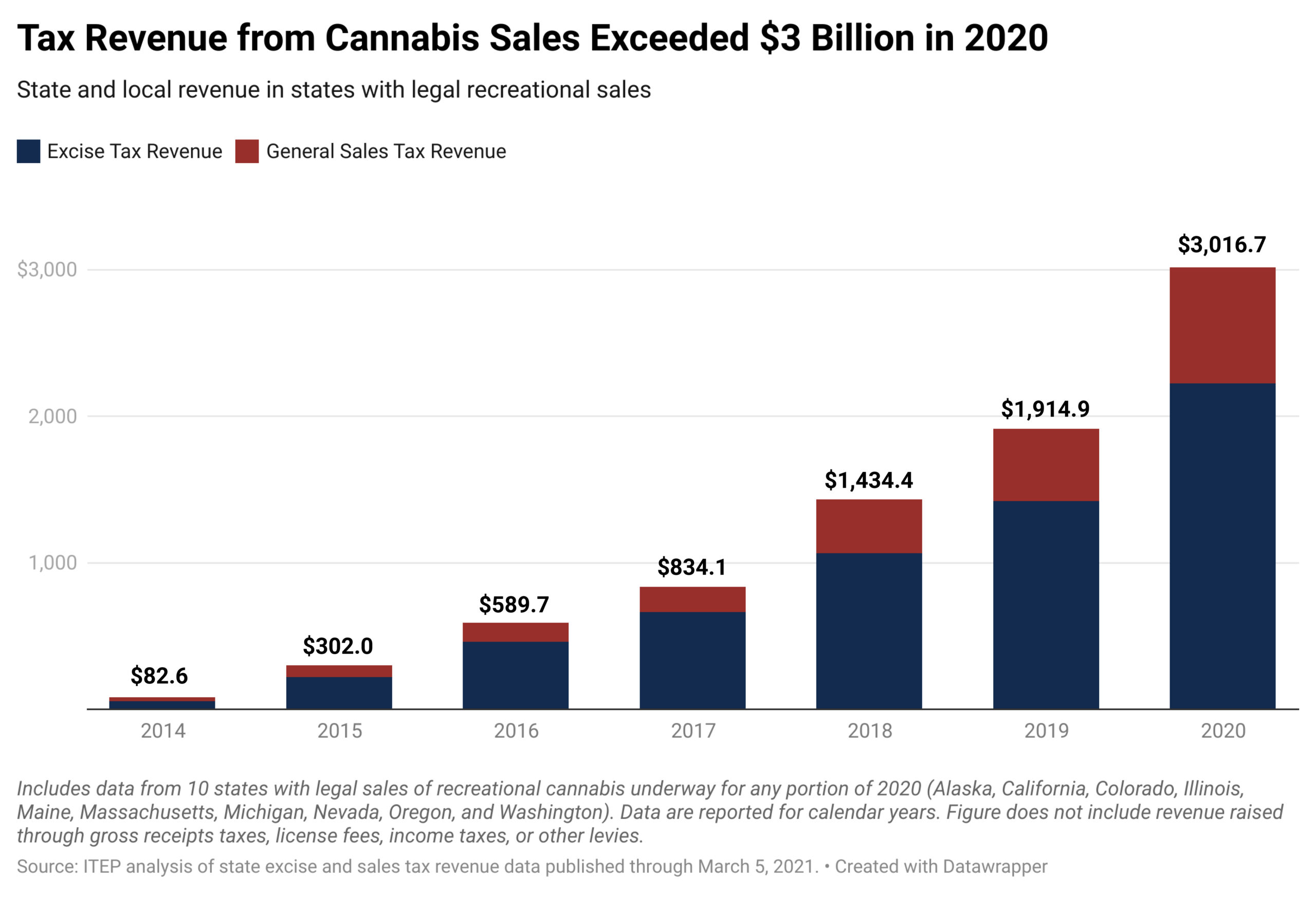

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

Michigan Sales Tax Where Does The Revenue Go And What Could An Increase Mean For Road Funding Mlive Com

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

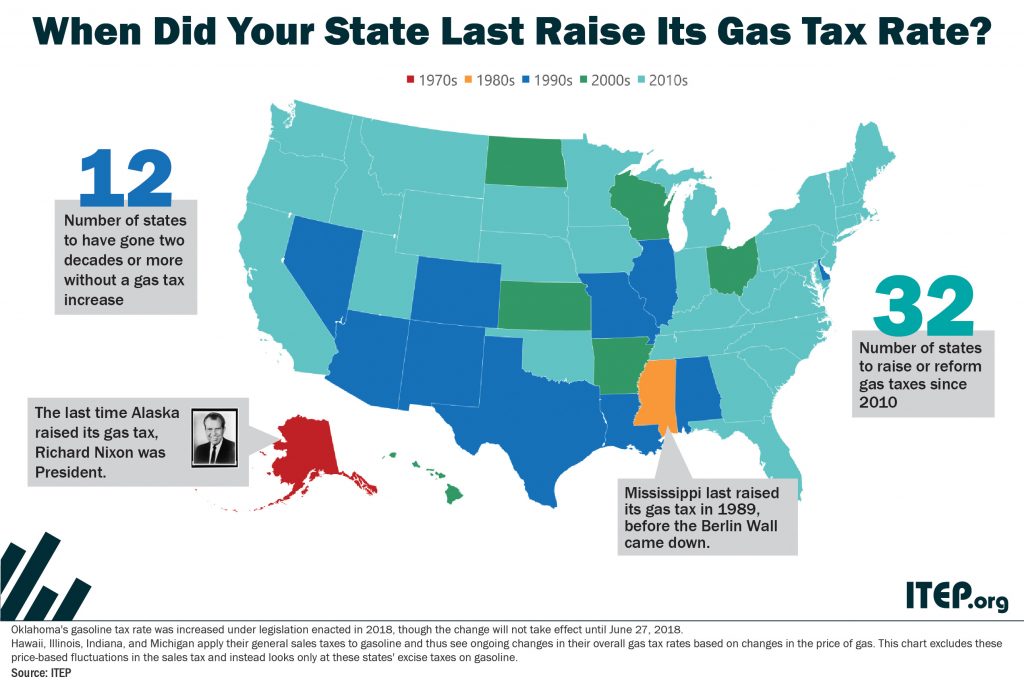

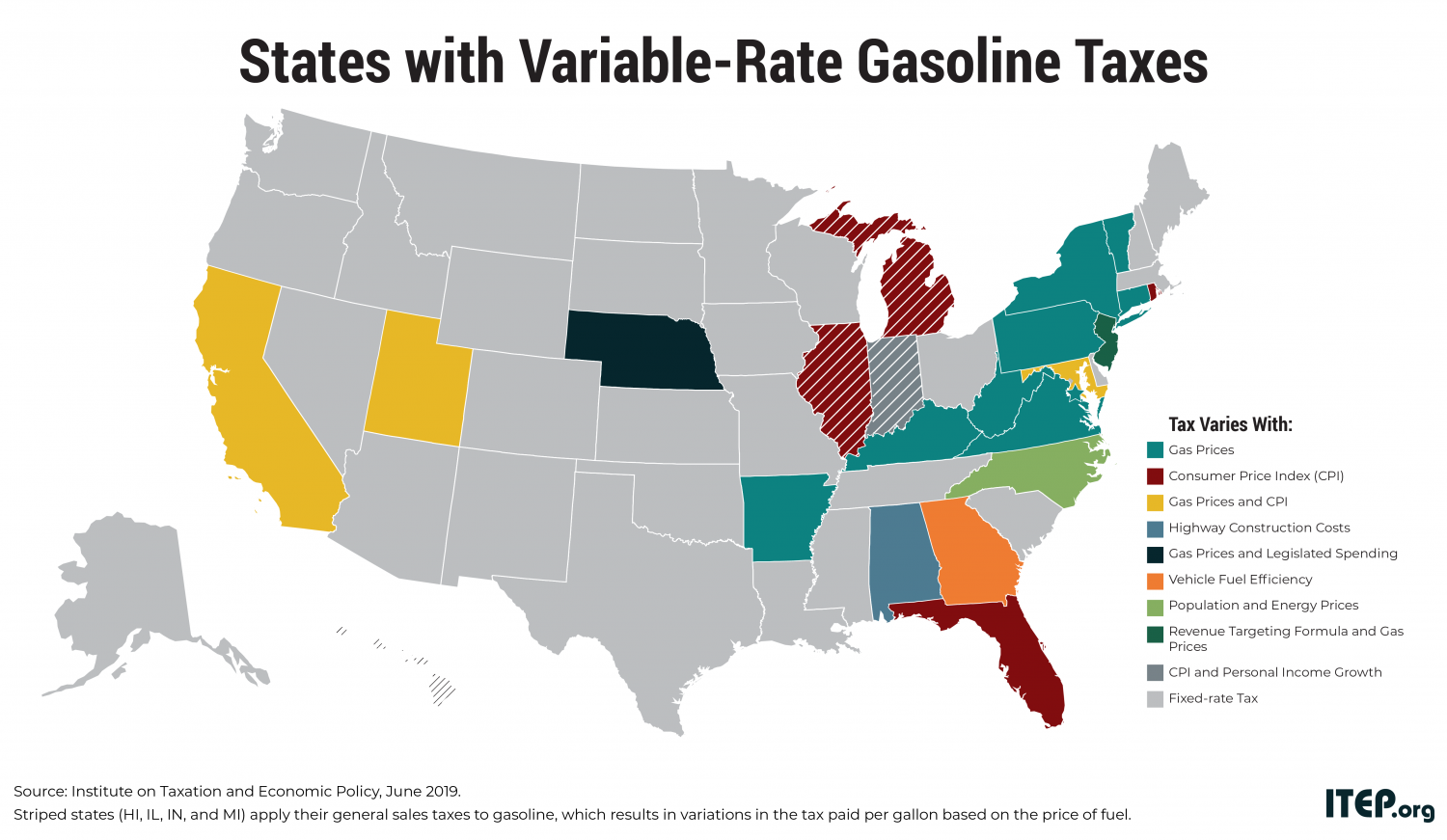

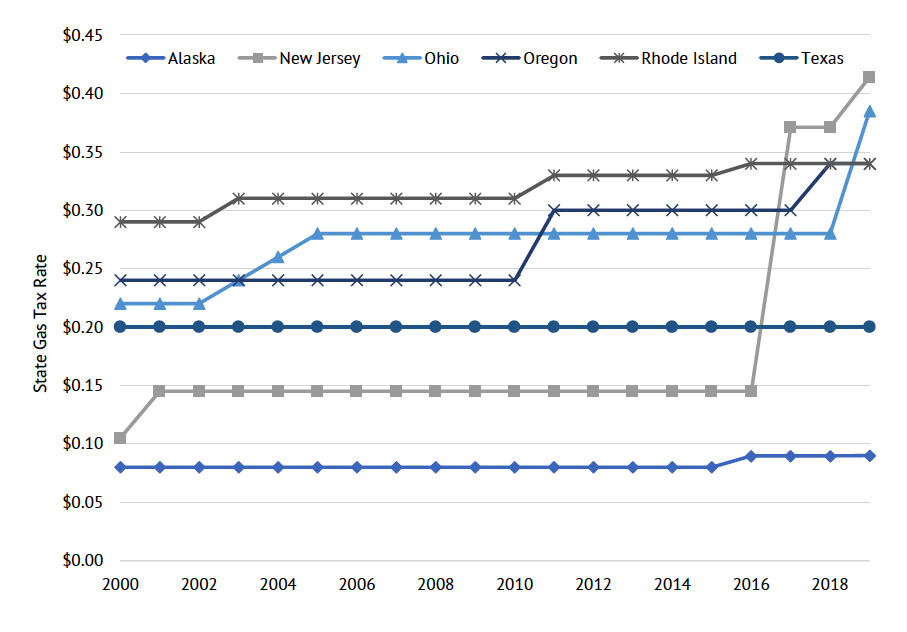

Most States Have Raised Gas Taxes In Recent Years Itep

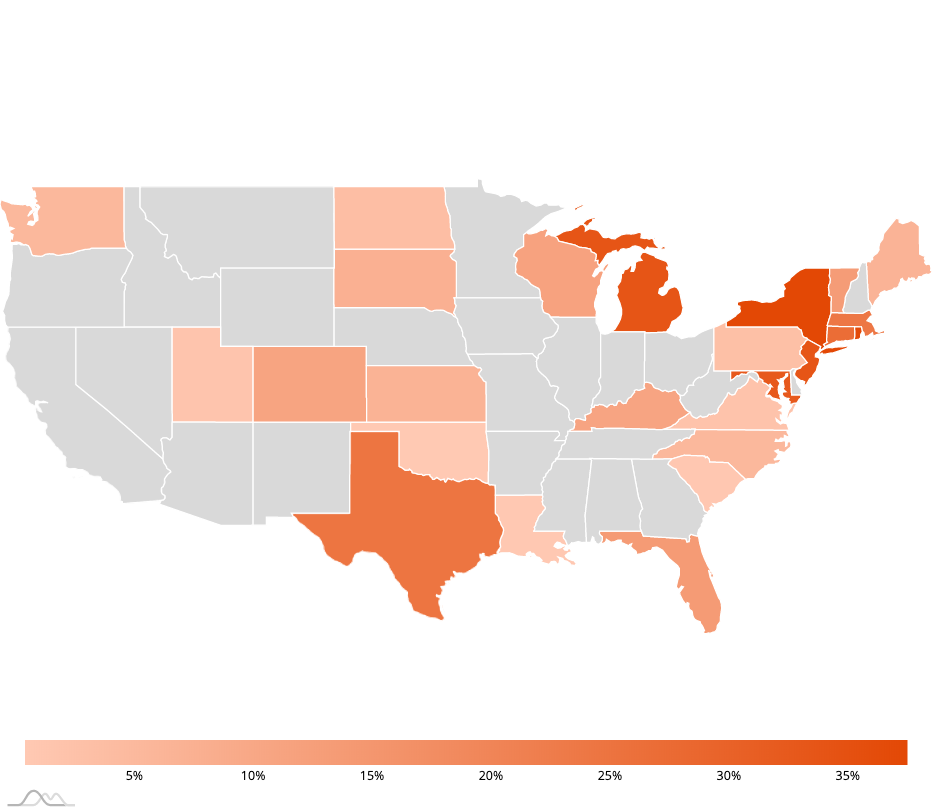

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

How Long Has It Been Since Your State Raised Its Gas Tax Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

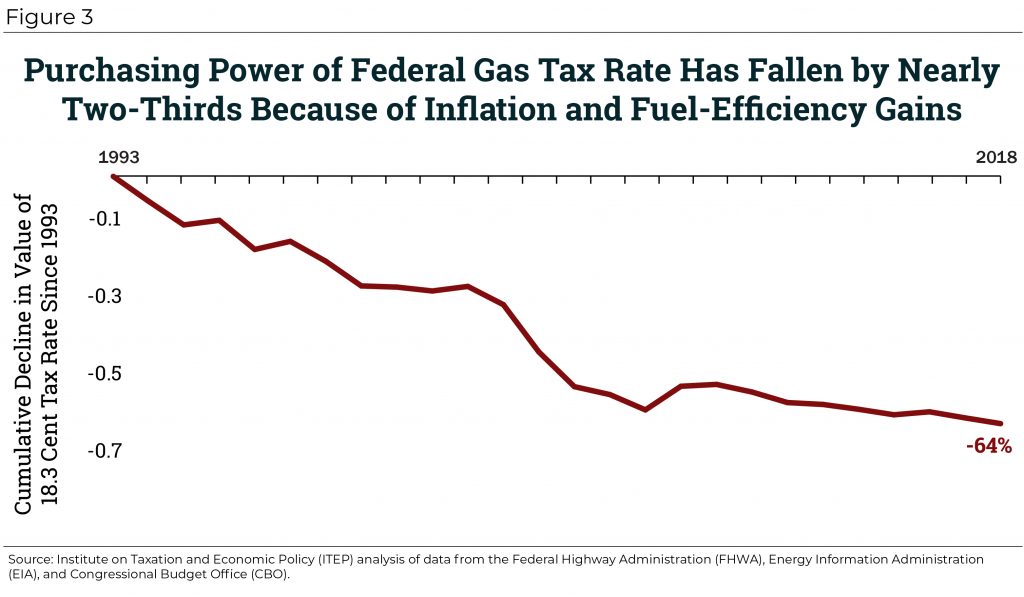

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Most Americans Live In States With Variable Rate Gas Taxes Itep

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax

Michigan Gas Tax Going Up January 1 2022

Historic Motor Fuel Tax Revenues Citizens Research Council Of Michigan

.png)

Map State Gasoline Tax Rates Tax Foundation

How Much Gas Tax Money States Divert Away From Roads Reason Foundation